Alibaba Short Sellers Burned Again Worlds Worst Bet

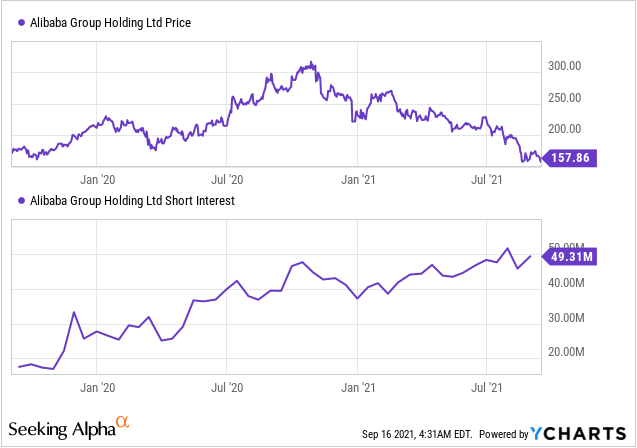

Alibaba'due south (NYSE:BABA) shares are downward by nearly 50% since their 52-calendar week highs just their bottom might not be in withal. Latest information reveals that short interest in the name actually surged past seven.7% and is now most its 2-year high. This suggests that market participants are forecasting the stock to further correct in value over the coming weeks and, in turn, should come up beyond every bit a concerning development for the company's long-side investors.

The Shorting Activeness

For the uninitiated, curt interest is basically the aggregate number of short positions that are open and are yet to be covered. A precipitous decline in the metric usually indicates that market participants accept actively wound up their short positions as, perhaps, they feel the stock has become adequately valued. Conversely, a sharp rise in the metric typically suggests that marketplace participants accept actively initiated brusque positions as, perhaps, they expect the stock to reject in value in the near future. And then, the short interest is a handy tool to gauge the Street's evolving sentiment pertaining to any given stock.

As far equally Alibaba is concerned, its short involvement at the end of the final cycle stood at 49.three million shares - up 7.7% sequentially and up 25.1% yr over year. The figure is now just 4% away from its 2-twelvemonth highs. Interestingly, this short interest build-up happened while Alibaba's shares continued to refuse. This indicates that market participants are stacking brusque bets in Alibaba in the hopes that the stock will further decline in value in the nigh future. For the tape, the data nether consideration is for bicycle catastrophe Baronial 31 and the data was disseminated less than a week agone.

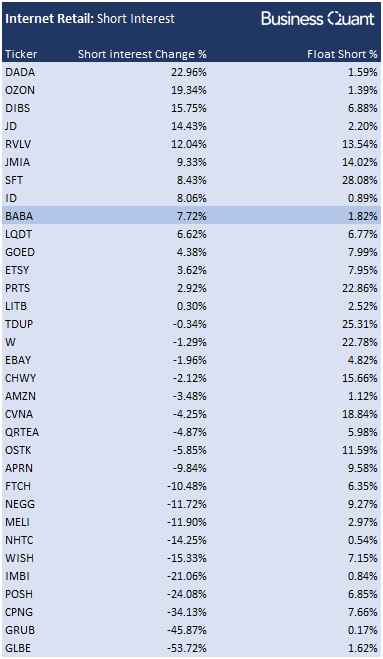

As a reminder, Alibaba's short involvement accounts for just about 2% or so of its entire public float, so there's plenty of room for its short interest to increase from current levels. The table below besides highlights that Alibaba'south brusk interest increase is college than several other internet retail stocks listed in the US. This suggests that market participants have grown relatively more comfortable in shorting Alibaba's shares as opposed to most of its peers mentioned beneath. This, coupled with the fact that Alibaba'due south brusk interest has risen to its multi-month highs, should encourage readers to tread with caution.

All of this raises the question - why are brusque sellers growing keen on shorting Alibaba'southward stock?

Reason for Caution

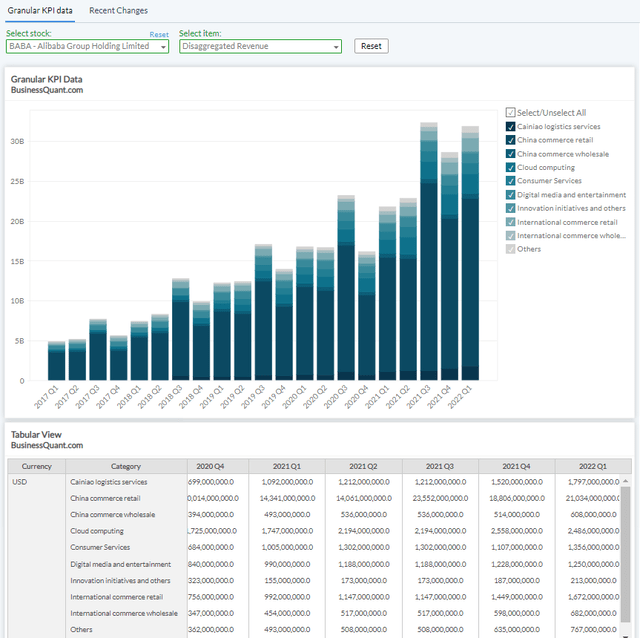

To be fair, Alibaba is growing rapidly on multiple fronts. Per our database, the company has 10 different revenue streams and all 10 of them grew at 20%-plus rates in its Q1 FY22 on a twelvemonth over yr basis. This is a commendable feat and it explains why growth-seeking investors - retail and institutional alike - across the globe have actively bought the stock in the contempo years.

(Source: BusinessQuant.com, company filings)

However, the problem lies with the US-listed Alibaba stock and its Variable Interest Entity (or VIE) structure. This construction doesn't offering any shareholding in the real Alibaba visitor, is essentially a beat out visitor and is illegal in Cathay.

Furthermore, per a law passed late last twelvemonth, strange companies are now required to undergo audits that are compliant with the Public Visitor Accounting Oversight Board (or PCAOB) of the Usa, or take chances getting delisted by 2024. The SEC'due south primary recently warned Chinese companies that he intends to strictly uphold the constabulary and the timeline. So, birthday, Chinese companies that are listed in the US, such as Alibaba, face regulatory risks from both Chinese and United states authorities.

Equally things stand, the PCAOB has to first get clearance from Chinese authorities to exist able to audit Alibaba's auditors and review their work papers. From Alibaba'south own 20-F filing:

PricewaterhouseCoopers, our auditor, is required nether U.S. police force to undergo regular inspections past the PCAOB. However, without approval from the Chinese government authorities, the PCAOB is currently unable to conduct inspections of the inspect work and practices of PCAOB-registered inspect firms inside the PRC on a basis comparable to other not-U.South. jurisdictions.

Also, there's no telling how stringent the auditing practices are in Mainland china. If Chinese companies such as Alibaba get audited according to PCAOB standards, we might see financial restatements and/or write-offs of unknown magnitudes.

Here's a hypothetical - many investors are finding Alibaba's shares to be attractively valued based on its low Cost-to-Sales (or P/S) multiple of iii.6x. Even so, if its past revenue figures were to be restated downward (in accordance with PCAOB standards) past let'south say 50%, so its effective P/S would surge to vii.2x. In that example, the stock might not exist all that undervalued anymore. We don't know if, when, and to what extent this might happen, only the betoken I'm trying to make here is that the US-listed Alibaba stock is fraught with risks and, it's understandable why market participants are shorting it.

Lastly, there's no telling when the Chinese government will end cracking down on large tech companies in the country. For instance, Chinese regulators had imposed a $ii.8 billion fine on Alibaba earlier this year for abusing its market place authorization. Earlier this calendar week, Chinese regulators struck once again and reportedly ordered Alibaba's affiliate, Ant Group, to split up its lending businesses - Huabei and Jiebei - and bring in outside shareholders. The regulators likewise want the firm to turn over user information, that's required for calculating credit ratings before making lending decisions, to a joint-venture that'due south partly state-owned.

Mind you, all this is being done with little to no transparency and Alibaba'due south VIE shareholders take negligible legal recourse. We besides don't know if Chinese regulators are finished with their crackdowns on Alibaba Group or of more such measures will follow. Moreover, nosotros don't know how competitive will Alibaba be mail its restructuring and how its financials volition exist impacted. For example, if Alibaba has to purchase its own user data from the separated businesses, its lending margins are likely to shrink. Similarly, if Alibaba marketplace has to become more accommodative for its merchants, then information technology may have to invest more capital to maintain its competitiveness which, over again, may injure the group's profitability. So, overall, there'south a lot of dubiety surrounding Alibaba for the time existence at least.

Last Thoughts

The takeaway here is that short sellers are gradually returning to Alibaba given the regulatory dubiety surrounding the company. While the company has grown at good for you rates so far, the intensifying shorting activity could human activity every bit a headwind for the stock in the most future. Therefore, risk averse investors may want to avoid the stock altogether. Alibaba's shares may not have bottomed out all the same. This, withal, should not be construed as a call to short the stock.

Good Luck!

This article was written by

Business Quant is a comprehensive investment research platform. It hosts KPI information, financial data and analytical tools to help you become a amend investor. You don't have to go through wearisome SEC filings to keep a track of AT&T's subscriber count, Apple'southward revenue from iPhones or Disney's revenue by region. Our Granular KPI Information tool does that for you and it does and so much more. Become an edge over the market, from mean solar day 1. Watch Business Quant in action here.

Disclosure: I/nosotros have no stock, option or similar derivative position in whatsoever of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am non receiving bounty for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4455734-alibaba-baba-stock-shorts-coming-back

0 Response to "Alibaba Short Sellers Burned Again Worlds Worst Bet"

Publicar un comentario